Members in a Tax group do not have to file separate Tax returns; the Parent entity can file a single tax retun on behalf of them all. The income and losses derived from individual entities are set off against each other.

The UAE Corporate Tax Law considers two or more Juridical taxable persons as a single Taxable person under the Tax Group mechanism, provided all applicable conditions are met. A key point to consider is the fact that a Tax group formed under the Corporate Tax Law is distinct from a Tax group formed under the Value Added Tax (VAT) regime.

Benefits of forming a Tax Group

Individual members in a Tax group are saved from the gruesome compliance requirements of having to file separate Tax returns and in its place a simplified single Tax return can be filed by the Parent entity on behalf of all members of the Tax group. Formation of a Tax Group also helps in reducing the overall tax burden of the Tax Group as the income and losses derived from individual entities in a Tax Group are generally set off against each other, helping the group save overall cash outflow.

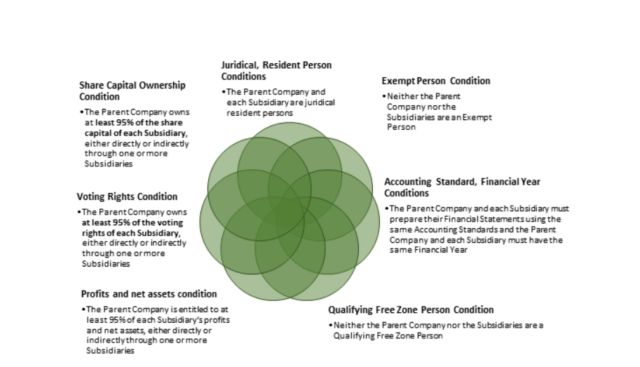

Tax Group conditions

The parent company and the subsidiary must continuously meet all of the above conditions throughout the relevant Tax Period during which the Tax Group rules are applied.

If either of the members fails to meet any of the conditions during any part of a tax period, the tax group will cease to exist from the beginning of that Tax period, except in cases where the parent company is replaced by another entity without discontinuing the Tax group or where a member of the Tax group ceases to exist as a result of transfer of a business within the same Tax Group.

It may be possible to form a Tax group again after it ceases to exist or to readmit a subsidiary that left the Tax Group if the relevant conditions are met in a later tax Period by submitting an application to the FTA.

Number of members in a Tax Group

There is no limit to the number of members of a Tax Group. However, a juridical person can only be a member of one Tax Group at any given time. Therefore, it is not possible for a Parent company to form multiple Tax Groups with different subsidiaries.

Further, the Tax Group guideline issued by the FTA prescribes that members in a tax Group is not required to have any connection or relation between the business or business activities of other members of the Tax Group.

How to attain Tax Group registration?

A resident parent company can make a joint application to form a Tax Group with one or more of its resident subsidiary companies seeking to become members of the Tax Group.

Juridical Person Condition

The parent entity and the subsidiaries must be Juridical persons, i.e., have a separate legal existence from its founders and directors. This condition rules out the possibility for sole establishments (natural persons carrying on business) being eligible for joining a Tax group as it does not fall under the ‘Juridical’ entity category.

Another area of focus to be concentrated upon lies under the Unincorporated Partnership form of business. While the corporate tax offers the flexibility to treat an Unincorporated Partnership as a Taxable person, it nevertheless considers UIP as a contractual relationship between natural persons that do not have a distinct legal personality separate from its partners/members. As UIP fails to attain a Juridical person status, they are ineligible to join a Tax Group. However, a juridical person who is a partner in a fiscally transparent UIP can be a member of a Tax Group as the said partner is a Juridical person.

Resident Person Condition

The Corporate Tax Law highlights that a Juridical person attains the status of a tax resident where:

- it is incorporated/established/recognized under the applicable legislation of the UAE or

- incorporated/ established/ recognized under the applicable legislation of a foreign jurisdiction, but is effectively managed and controlled in the UAE (i.e., tax resident in the UAE for the purposes of an applicable Double Taxation Agreement in force in the UAE).

Dual resident person

If a resident juridical person is considered a dual resident person, the Double Taxation Agreements (DTA) are considered as the final tie-breaker. If the DTA so consulted defines the entity as a solely UAE tax resident, the entity can be admitted as a member of a Tax Group.

However, if the DTA regards the entity as a tax resident of a foreign jurisdiction under the tie-breaker rule, then that resident person cannot form or be a member of a Tax Group.

If a dual person had qualified as a member of a Tax Group in earlier tax periods, but subsequently is treated as a tax resident of a foreign jurisdiction under the tie-breaker rule of an applicable DTA, then that member ceases to be a member of the Tax Group from the beginning of the Tax Period in which the member became a tax resident of the foreign jurisdiction.

In cases where the DTA fails to provide a conclusive tie-breaker rule for dual resident persons, tax residence is determined through mutual agreement of the competent authorities of both countries. In such cases, the person is considered a tax resident of both countries until a conclusion is reached by the competent authorities. As a result, the resident person is not eligible to join or form a Tax Group until the mutual agreement procedure is concluded and the tax residence is allocated in the UAE by the competent authorities under the relevant DTA.

Alternatively, if the entity is also a tax resident under a foreign jurisdiction with which the UAE does not have a DTA in force, the resident person would still be eligible to join a Tax Group.

Parent Company held by a non-resident person

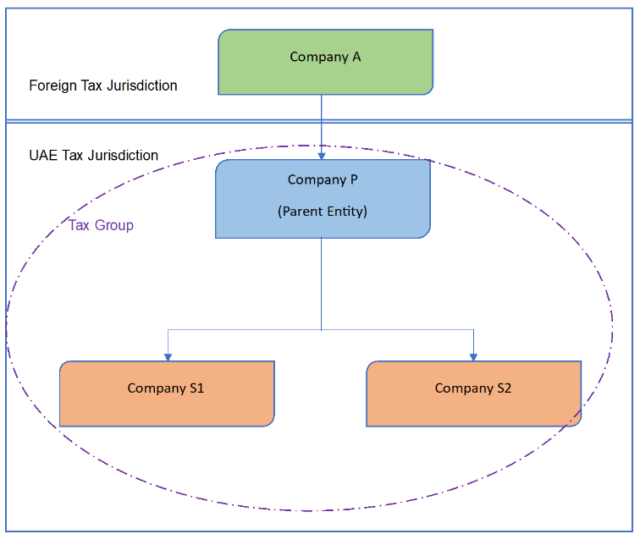

Although a foreign tax resident juridical person is not eligible to join a tax group in the UAE, if such an entity holds control (either directly or indirectly) over another juridical entity that is both a UAE Tax resident and a Parent company, having subsidiaries who also satisfies the UAE tax residency criteria, the corporate tax law allows for such UAE Parent and subsidiaries are eligible to join a tax group. This is being examined using the following example:

Company A is a tax resident of a foreign jurisdiction and holds control over Company P, which is a tax resident of the UAE. Company P has two subsidiaries (Company S1 and Company S2) which are also tax residents in the UAE.

Provided company P and its subsidiaries (S1 and S2) satisfy the UAE Tax residency criteria, these 3 Juridical entities are eligible to jointly apply to the FTA to form a Tax Group.

Share Capital Ownership Condition

To form a Tax Group, the parent company must own at least 95% of the share capital in each of the subsidiaries, either directly or indirectly through one or more subsidiaries. Share Capital consists of share capital that has not been issued and paid up but does not include share capital that has been authorized but not yet issued and/ or paid up.

Share Capital can also include capital invested in other forms of juridical person such as membership or Partnership Capital. Further, capital in an incorporated partnership or units of a trust also qualifies as share capital where such entities are treated as juridical persons according to the law under which they are incorporated.

Shares with different nominal values:

When an entity has issued 2 classes of shares to its shareholders, the Parent-subsidiary relationship can be established when the Parent entity holds 95% of the total issued and paid-up share capital (which is weighted by reference to the respective nominal values of share classes issued). This is illustrated using the below example:

Company A has issued 2 classes of shares, with an aggregate paid-up capital of AED 11,000. Company P owns 100% of Class A shares in addition to 10% (20 shares) of Class B shares.

| Share Classes of Company A | No. of shares issued | Nominal Value per share | Total Capital (i) | No. of shares held by P | Total Value of shareholding (ii) | % of Holding (ii/i) |

| Class A | 1,000 | 10 | 10,000 | 1,000 | 10,000 | |

| Class B | 200 | 5 | 1,000 | 20 | 100 | |

| Total | 11,000 | 10,100 | 91.8% |

Although, Company P holds 100% of Class A shares in Company A, the net shareholding comes down to 91.8%, falling short of the minimum holding requirement of 95% to be conferred the title of Parent company, and therefore becoming ineligible to form Tax group with company A.

While different types of shares (including Ordinary shares, Preferred shares, etc.) should be considered when computing the proportionate control for determining the subsidiary criteria, any other instruments issued which are not share capital (convertible loans, warrants, options over shares that have not been issued) should not be considered in determining whether the share capital ownership condition has been met.

Indirect Ownership

Entities can form a tax group through the indirect ownership mode where it can be demonstrated that the parent entity along with its other subsidiaries in aggregate holds more than 95% of the overall share ownership of the incoming subsidiary. In case where the co-owning subsidiary has minority interest, the overall ownership of the parent entity in the incoming subsidiary will be assessed as a proportion to the share ownership in the intermediary subsidiary.

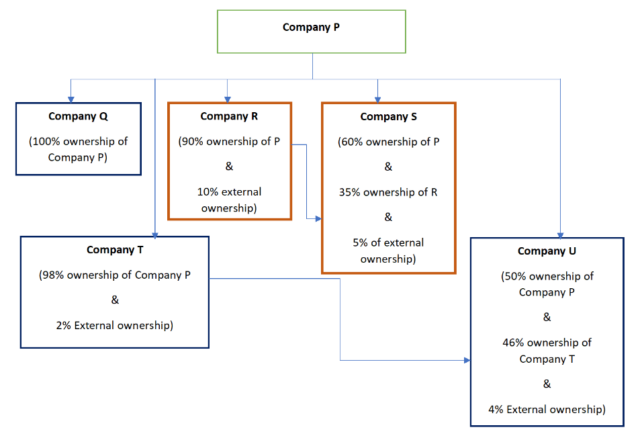

Let us look into the below illustrative group structure.

Company P is a resident juridical entity in the UAE and holds ownership interest with varying proportion across entities Q, R, S, T and U, which are also resident juridical persons in the UAE.

- Company Q fulfils the subsidiary conditions of Tax grouping as 100% shares are owned by the Parent entity, Company P.

- Company R does not fall fulfil the conditions of subsidiary classification under the tax grouping mechanism as the parent holds less than 95% of the ownership interest in the entity.

- In the case of Company S, the parent entity holds a direct ownership to the tune of 60%. However, since Company R doesn’t fall under the category of a subsidiary, the 35% ownership does not equate to an indirect ownership structure for Company P, hence Company S also fails to fulfil the conditions for classifying as a Subsidiary.

- Company P holds more than 95% of share ownership in Company T, hence fulfilling the conditions for recognizing as a Subsidiary.

- Finally, the parent entity holds 50% direct ownership in Company U and holds 45.08% indirect ownership through the subsidiary T (98% in Company T x 46% in Company U), aggregating to 95.08%, thereby fulfilling the conditions for classifying Company U as a subsidiary of the Parent entity, P through the combination of both direct and indirect ownership.

Hence in the above example, entities P, Q, T and U are eligible to form a Tax group.

What are the compliance requirements of Tax groups?

The parent company and each of the subsidiary companies will be jointly and severally liable for the corporate tax payable by the tax group for the periods during which such members are part of the tax group. However, the joint and several liability may be limited to one or more members of the Tax group following approval from the authority.

The parent company shall be responsible for:

- settling the Tax Groups’ Corporate Tax Due and applying for Corporate Tax Refunds (where applicable).

- compliance with the provisions of Corporate Tax registration and deregistration requirements.

- filing tax returns, maintaining relevant financial statements, and other required records including Transfer Pricing documentation and submission of clarifications when necessary.

How does the Tax Grouping affect the Withholding Tax liability?

Both parent and subsidiary shall remain responsible for complying with the provisions of withholding tax. Although the current rate of withholding taxes in UAE is maintained at 0%, at such time when the withholding taxes are raised by the FTA, the responsibility to deduct withholding tax and the timely remittance of the collected amount to the authority will fall on each of the members of the tax group, that is, the parent will not be held responsible for fulfilling the withholding tax obligations on behalf of the subsidiaries in the Tax Group.

How can entities join an existing tax group?

A subsidiary can join an existing tax group following the submission of an application to the FTA by both the parent and the relevant subsidiary.

A parent company in a tax group can be replaced without discontinuation of the tax group. This can be achieved by making an application to the FTA for such replacement and will be allowed in any of the following two cases:

- When the new parent entity meets the ownership criteria over its subsidiary as listed above, or

- When the former parent company ceases to exist and the new parent company is its universal legal successor.

The entity joining the tax group will be considered to be have joined from the beginning of the Tax Period specified in the application submitted to FTA or from the beginning of any other tax period as determined by FTA.

How can a subsidiary leave the tax group?

A subsidiary shall leave the tax group in any of the following circumstances:

- Where the parent company and the relevant subsidiary make an application to the authority and are duly approved

- Where the said subsidiary no longer meets the condition to be a member of the Tax Group.

The entity would be considered to be leaving the Tax Group from the beginning of the Tax Period specified in the application submitted to the Authority, or from the beginning of any other Tax Period as determined by the FTA.

However, when a subsidiary is leaving the tax group due to non-compliance with the membership conditions of forming a tax group, the entity will be considered to be leaving the Tax group from the beginning of the Tax period in which the conditions are no longer met.

When does a Tax Group Cease to exist?

A tax group shall cease to exist under the following cases:

- Following approval by the authority of an application made by the parent company for such cessation, or

- Where the parent company no longer meets the conditions to form a Tax group, or

- When the authority may, at its discretion, dissolve a tax group based on the information available to the authority.

The Authority may also change the parent company of a tax group based on information available to them, however, any such action taken will be notified to the parent company.

If you want to register for vat or corporate tax, ATB Legal helps with vat registration and corporate tax registration in the UAE.