In the UAE, business activities are broadly classified into two categories: Regulated and Unregulated.

Regulated activities are those that require additional approvals from government authorities or regulatory bodies. Examples include financial services, healthcare, education, and legal services.

Unregulated activities do not require any special regulatory approval apart from the standard business licensing process. These typically include trading, consulting, and general services.

Understanding Activities, Activity Groups and License Types

In the UAE, business activities are categorized into Professional, Commercial, Industrial, and Service licenses. These classifications are largely consistent across the mainland (under the Department of Economic Development—DED) and various free zones, although there can be some differences depending on the emirate or free zone.

The number of activity groups in the UAE varies depending on the jurisdiction, as each emirate and free zone authority may have its own classification system. However, the Department of Economic Development (DED) in Dubai, which is one of the most comprehensive regulators, currently categorizes activities into over 2,000 business activities grouped into around 13 broad activity groups. These broad activity groups include:

- Agriculture, Livestock, and Fishing

- Mining and Quarrying

- Manufacturing

- Electricity, Gas, and Water

- Construction

- Wholesale and Retail Trade

- Transportation and Storage

- Accommodation and Food Services

- Information and Communications

- Financial and Insurance Activities

- Real Estate, Renting, and Business Services

- Education

- Health and Social Work

Each of these broad categories contains several subcategories that specify the exact nature of the business activity. The specific number of activity groups and subcategories can differ slightly across different emirates and free zones, depending on their focus and regulatory structure. For example, some free zones might have specialized activity groups tailored to industries like technology, media, or logistics.

License Types

Here’s what typically falls under each license type:

- Professional activities are service-oriented and require specific expertise or qualifications.

- Commercial activities center around trading, retail, and other business operations involving the sale of goods.

- Industrial activities focus on manufacturing and production.

- Service activities include operational and maintenance services, hospitality, logistics, and similar support roles.

If you need more precise information about a particular jurisdiction, you may contact us by phone, Whatsapp or email.

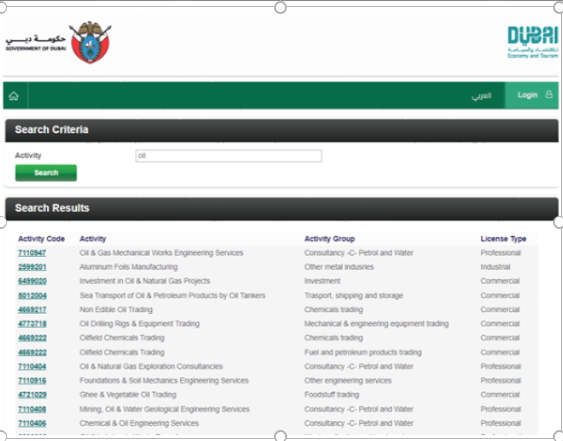

Below, you may find an illustrative screenshot of activities as searched and found on the DED web portal.

For more information or to search for specific business activities:

- For activities in Dubai mainland, you can use the Dubai DED Business Activity search tool.

- For activities in the International Free Zone Authority (IFZA), you can use the IFZA Business Activities search tool.

Please see a slightly more detailed elucidation of the license types below, with licensing requirements and examples for each license type.

Professional License

Professional activities involve the provision of specialized services based on skills, expertise, and intellectual capabilities. These activities usually require specific qualifications or professional certifications.

Licensing Requirements: These activities typically require individuals to have relevant qualifications and may involve professional certifications.

Examples:

- Consultancy Services: Management Consulting, IT Consulting, Legal Consultancy, Financial Advisory

- Medical Services: Clinics, Dental Practices, Physiotherapy Centers

- Educational Services: Training Institutes, Private Tutors

- Freelance Services: Graphic Design, Copywriting, Marketing Consultancy

- Engineering Services: Architectural Design, Project Management, Civil Engineering Consultancy

- Accounting and Auditing Services

Commercial License

Commercial activities focus on trading and business operations involving buying and selling goods, whether locally or internationally.

Licensing Requirements: These activities are typically licensed for entities engaged in selling products or conducting commercial transactions.

Examples:

- Retail and Wholesale Trading: Supermarkets, Electronics Shops, Clothing Stores

- Import and Export: Foodstuff Trading, Automobile Trading, Furniture Trading

- Real Estate Brokerage: Property Sales, Leasing, and Management

- E-commerce: Online Retail Platforms, Dropshipping Businesses

- General Trading License: Allows trading in multiple goods across categories under a single license.

Industrial License

Industrial activities involve the production, manufacturing, processing, and assembly of goods.

Licensing Requirements: Industrial activities often require substantial infrastructure, machinery, and factory setups. Approvals from relevant environmental and safety authorities may be required.

Examples:

- Manufacturing: Textile Manufacturing, Food Processing, Furniture Production

- Packaging and Bottling: Beverage Packaging, Cosmetic Packaging

- Steel and Metal Fabrication

- Printing and Publishing: Commercial Printing, Book Publishing, Packaging Printing

- Chemical Production: Paints Manufacturing, Plastic Production

Service License

Service activities are broad and typically involve offering a range of support, maintenance, and operational services. These activities often overlap with professional and commercial categories but are more focused on service delivery rather than trading or manufacturing.

Licensing Requirements: Service activities often require specific approvals, depending on the nature of the services offered, especially if they relate to health, safety, or security.

Examples:

- Maintenance Services: Building Maintenance, HVAC Maintenance, Plumbing Services

- Logistics and Transportation: Freight Forwarding, Courier Services, Warehousing

- Event Management: Event Planning, Exhibitions, Corporate Event Services

- Hospitality Services: Catering, Hotel Management, Travel Agencies

- Cleaning Services: Residential Cleaning, Commercial Cleaning, Pest Control

- Security Services: Private Security Companies, CCTV Installation

These classifications help determine the appropriate license and regulatory requirements for businesses operating in the UAE. It is generally not permitted to combine activities from different groups under a single license. For example, activities classified under both trading and consulting cannot be grouped on the same license. Additionally, activities from different activity types—like combining commercial and professional services—are also restricted from being grouped together.

Activities that Cannot Coexist

Some activities cannot coexist under a single license in the UAE. Although there can be exceptions, typically, activities belonging to different activity groups cannot coexist. Activities must be related and fall under the same general category or activity group to be grouped under a single license. However, be informed that there can be exceptions, and laws are constantly updated in the UAE to increase the ease of doing business, ensure national security and comply with international laws of transparency. Some illustrative examples of activities that cannot coexist include:

Trading and Consulting Activities

A license cannot combine trading activities, such as “General Trading” or “Electronics Trading,” with consulting services like “Management Consulting” or “Legal Consultancy.” Trading and consulting fall under different activity types—commercial and professional, respectively—and cannot be grouped together.

Real Estate Brokerage and Manufacturing

A business engaged in “Real Estate Brokerage” cannot simultaneously operate manufacturing activities, such as “Furniture Manufacturing” or “Packaging Production,” under the same license. Real estate falls under commercial activities, while manufacturing is classified as an industrial activity.

Healthcare Services and Retail

Activities like operating a “Medical Clinic” cannot coexist with retail activities, such as running a “Pharmacy” or “Retail Store.” These are distinct sectors with different regulatory requirements and licensing needs.

Food and Beverage Trading with Financial Services

A company cannot hold a license that combines “Foodstuff Trading” with financial services like “Investment Advisory” or “Asset Management.” These activities are entirely unrelated, with different classifications and regulatory approvals needed.

Understanding Regulated Activities

The regulated activities require additional approvals from relevant authorities beyond the standard business licensing process. The fees for additional approvals for regulated activities in the UAE vary depending on the specific regulatory authority, the type of activity, and the nature of the business. Here’s an overview of the fee structures for some common regulated activities:

Financial Services

- Regulatory Authorities: Central Bank of the UAE, Securities and Commodities Authority (SCA)

- Examples: Banking, Investment Advisory, Asset Management

- Fees: Can range from AED 20,000 to AED 100,000 or more, depending on the nature of the financial services (e.g., banking, brokerage, investment advisory).

- Renewal Fees: Additional annual fees may apply, ranging from AED 15,000 to AED 50,000.

Healthcare Services

- Regulatory Authorities: Department of Health (DOH), Dubai Health Authority (DHA), Ministry of Health and Prevention (MOHAP)

- Examples: Medical Clinics, Hospitals, Pharmaceuticals

- Fees: Initial approval fees for clinics or hospitals can range from AED 10,000 to AED 50,000.

- Renewal Fees: Typically range from AED 5,000 to AED 20,000 annually.

- Additional fees may apply for facility inspections and professional licensing.

Education and Training

- Regulatory Authorities: Knowledge and Human Development Authority (KHDA), Ministry of Education (MOE), Department of Education and Knowledge (ADEK)

- Examples: Schools, Universities, Vocational Training Institutes

- Fees: Approvals for schools and universities can range from AED 20,000 to AED 100,000, depending on the level and type of institution.

- Renewal Fees: Annual fees typically range from AED 10,000 to AED 30,000.

Legal Services

- Regulatory Authorities: UAE Ministry of Justice, Department of Legal Affairs (in free zones), DIFC Courts, ADGM Courts

- Examples: Law Firms, Legal Consultancy, Arbitration Services

- Fees: Fees for establishing a law firm or legal consultancy can range from AED 10,000 to AED 50,000.

- Renewal Fees: Annual fees usually range from AED 5,000 to AED 20,000.

Media and Publishing

- Regulatory Authority: National Media Council (NMC)

- Examples: Newspapers, Magazines, Broadcasting, Digital Media

- Fees: Approval fees for media licenses range from AED 15,000 to AED 40,000.

- Renewal Fees: Annual renewal fees typically range from AED 5,000 to AED 15,000.

Telecommunications and IT Services

- Regulatory Authority: Telecommunications and Digital Government Regulatory Authority (TDRA)

- Examples: Internet Service Providers, Telecom Operators, Cybersecurity Services

- Fees: Licensing fees can range from AED 50,000 to AED 200,000 or more for telecom-related activities.

- Renewal Fees: Annual renewal fees vary, often starting at AED 20,000.

Tourism and Hospitality

- Regulatory Authorities: Department of Tourism and Commerce Marketing (DTCM), Department of Culture and Tourism (DCT)

- Examples: Travel Agencies, Hotels, Tour Operators

- Fees: Fees for hotel or travel agency approvals range from AED 5,000 to AED 30,000.

- Renewal Fees: Annual renewal fees are typically between AED 5,000 and AED 15,000.

Food and Beverage Production and Distribution

- Regulatory Authorities: Food Control Authority (varies by emirate), Dubai Municipality

- Examples: Food Manufacturing, Restaurants, Catering Services

- Fees: Approval fees for food businesses can range from AED 5,000 to AED 20,000, with additional costs for inspections and certifications.

- Renewal Fees: Annual renewal fees usually range from AED 3,000 to AED 10,000.

Important Notes:

- Inspection and Certification Costs: Many regulated activities require periodic inspections, professional certifications, and other compliance costs, which can add to the overall expense.

- Activity-Specific Fees: The exact fees can vary significantly based on the type and scope of the activity and the emirate in which the business is registered.

For precise fee details, it’s recommended to directly consult licensed business setup consultants such as ATB Legal.

One comment

SavePlus UAE

February 28, 2025 at 3:32 pm

This detailed blog provides essential insights into business activities and company formation in the UAE, making it a must-read for entrepreneurs!