Saudi Arabia offers a diverse range of business zones, each designed to cater to different industries and investment needs. These zones provide unique advantages for foreign and domestic businesses, from tax incentives to cutting-edge infrastructure. Choosing the right zone for your business can unlock significant growth opportunities and align your operations with Saudi Arabia’s Vision 2030. This guide explores the various business zones in Saudi Arabia available in the Kingdom and their benefits to help you find the perfect fit for your venture.

Download as PDF, Please Click Here Business zone !!

Types of Business Zones in Saudi Arabia

Special Economic Zones (SEZs)

SEZs are strategically designed to offer businesses tailored tax and regulatory benefits, attracting industries such as logistics, manufacturing, and advanced technologies. These zones often provide custom duty exemptions, reduced corporate taxes, and streamlined regulations to make business operations more efficient.

This blog is a part of our Company Incorporation in Saudi Arabia: A Comprehensive Guide Pillar blogpost.

Example: King Abdullah Economic City (KAEC)

Located on the Red Sea coast, KAEC is one of the largest economic zones in Saudi Arabia, offering exceptional infrastructure and a range of incentives for companies in logistics, manufacturing, and trade. Businesses in KAEC benefit from its proximity to key shipping routes, a highly efficient port, and a seamless connection to national and international markets.

Benefits of SEZs

- Custom Duty Exemptions: Businesses operating in SEZs enjoy zero tariffs on imports and exports.

- Tax Benefits: Reduced corporate taxes and customs duties create a financially attractive environment.

- Ideal For: Logistics, advanced manufacturing, and international trade operations.

Free Zones

Free Zones offer unmatched benefits for foreign investors, including 100% foreign ownership and no corporate taxes, making them a preferred destination for sectors like logistics, e-commerce, and technology. These zones are designed to enhance international trade and investment while allowing businesses to operate with greater autonomy.

Example: King Salman Energy Park (SPARK)

SPARK is a massive energy-focused free zone designed to attract global energy companies. With advanced infrastructure and 100% foreign ownership, it serves as a hub for the energy sector, providing space for manufacturing, services, and innovation in renewable energy and oil and gas.

Benefits of Free Zones

- Full Ownership: Foreign investors can fully own their companies without the need for local partners.

- No Corporate Taxes: Businesses operating in free zones enjoy significant tax savings, as no corporate income tax is imposed.

- Ideal For: E-commerce, logistics, energy, and technology companies.

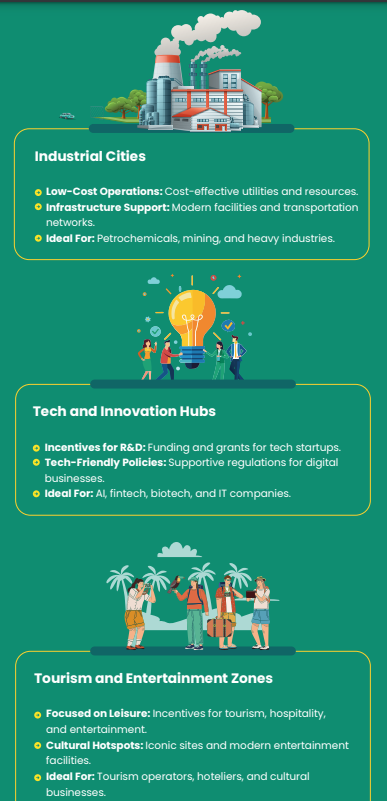

Industrial Cities

Industrial Cities are designed for heavy industries and manufacturing sectors, offering businesses lower operational costs and access to world-class infrastructure. These zones focus on sectors like petrochemicals, manufacturing, and mining, providing ample resources and support for large-scale industrial operations.

Example: Jubail and Yanbu Industrial Cities

These two industrial powerhouses are crucial to Saudi Arabia’s petrochemical and manufacturing industries. Both cities provide extensive facilities for petrochemical production, mining, and heavy manufacturing, with excellent transportation links for exporting goods globally.

Benefits of Industrial Cities

- Low-Cost Operations: Businesses enjoy cost-effective utilities, affordable land, and streamlined supply chains.

- Infrastructure Support: Modern facilities, advanced transportation networks, and port access ensure smooth operations.

- Ideal For: Petrochemicals, mining, heavy industries, and large-scale manufacturing.

Tech and Innovation Hubs

Tech and Innovation Hubs are tailored for companies in the technology, research, and development sectors. These hubs offer numerous incentives, including funding for research and development (R&D) projects and favorable regulations for startups. Saudi Arabia is keen on attracting high-tech industries to drive its innovation economy.

Example: Riyadh Techno Valley

Riyadh Techno Valley is a leading innovation hub offering incentives for tech startups, research institutions, and multinational companies. The hub focuses on industries like AI, fintech, biotechnology, and IT, providing a supportive ecosystem for companies aiming to innovate and grow.

Benefits of Tech and Innovation Hubs

- Incentives for R&D: Grants, funding, and research partnerships are available for cutting-edge technology projects.

- Tech-Friendly Policies: Businesses benefit from flexible regulations designed to support digital enterprises.

- Ideal For: AI, fintech, biotech, IT, and other tech-driven industries.

Tourism and Entertainment Zones

Tourism and Entertainment Zones support Saudi Arabia’s Vision 2030 goals to develop the tourism and entertainment sectors. These zones offer specific incentives for hospitality, entertainment, and retail businesses, focusing on both preserving the Kingdom’s cultural heritage and promoting modern entertainment experiences.

Example: AlUla and Qiddiya

AlUla is an ancient cultural site, now a hub for heritage tourism, while Qiddiya is set to become a major entertainment destination with theme parks, sports arenas, and leisure facilities. Both zones provide exclusive incentives to investors in hospitality, retail, and entertainment.

Benefits of Tourism and Entertainment Zones

- Focused on Leisure: These zones offer tax incentives, streamlined permits, and dedicated infrastructure to support businesses in tourism and entertainment.

- Cultural Hotspots: AlUla’s UNESCO heritage sites and Qiddiya’s modern entertainment facilities attract global visitors, creating vast opportunities for investment.

- Ideal For: Tourism operators, hoteliers, cultural businesses, and entertainment enterprises.

Saudi Arabia’s business zones offer a range of tailored benefits designed to meet the needs of diverse industries. Whether you are looking to establish a manufacturing plant, launch a tech startup, or invest in the Kingdom’s booming tourism sector, there is a business zone that caters to your requirements. By selecting the right zone for your business, you can maximize growth potential, tap into government incentives, and contribute to Saudi Arabia’s dynamic economy.