The Dubai International Financial Centre (DIFC) was established in 2004 to position Dubai as a leading capital market, boasting its own judicial system. Inspired by English law, this system mirrors the procedures of English courts, overseeing civil and commercial transactions within the DIFC.

Since its inception, the DIFC has drawn approximately 880 companies, predominantly operating in the financial and banking sectors. Additionally, it serves as a base for businesses offering support services to these industries. Consequently, the DIFC has emerged as a pivotal destination for international enterprises seeking to establish a foothold in the Middle East.

Given its significance, individuals and entities looking to engage within the DIFC should familiarize themselves with the operations of the DIFC Court and the procedural advantages it offers over conventional litigation in UAE courts. Despite its geographical size, the DIFC’s dense concentration of global businesses underscores its importance as a jurisdiction.

Related Services: Litigation and Dispute Resolution

In recent years, the DIFC Court has handled a myriad of cases spanning employment, contracts, investments, and insolvency. As commercial activities within the DIFC continue to burgeon, it is anticipated that the caseload before the DIFC Court will correspondingly escalate.

Jurisdiction and Legal Framework

The DIFC Courts were established through legislation enacted by the late Ruler of Dubai, His Highness Sheikh Maktoum bin Rashid Al Maktoum. Dubai Law No. 12 of 2004, amended by Dubai Law No. 16 of 2011, outlines the jurisdiction and independent administration of justice within the DIFC. Additionally, DIFC Law No. 10 of 2004 details the powers, procedures, functions, and administration of the DIFC Courts. Situated within Dubai’s financial hub, the DIFC Courts operate as a distinct common law jurisdiction, complementing the UAE’s civil law system.

They handle commercial and civil disputes at local, regional, and global levels, conducting proceedings in English. Although initially the DIFC Courts were established to hear cases limited within the DIFC’s geography, owing to its widespread success and acclaim it received for swift and efficient justice, the DIFC Courts’ jurisdiction was extended in 2011 which allowed the court to hear i) Any civil or commercial case in which both parties select the DIFC Courts’ jurisdiction, either in their original contracts/agreements or post-dispute ii) as well as any civil, commercial or employment claim related to the DIFC. However, the DIFC court does not have jurisdiction over criminal matters in the U.A.E.

To effectively utilize the DIFC Courts, legal professionals, and companies are encouraged to include jurisdiction clauses in their contracts for dispute resolution. The legislative framework governing the DIFC Courts aims to uphold international standards of legal procedure, ensuring certainty, flexibility, and efficiency. This framework facilitates the resolution of a wide range of civil and commercial disputes, from complex financial transactions to employment and debt collection matters.

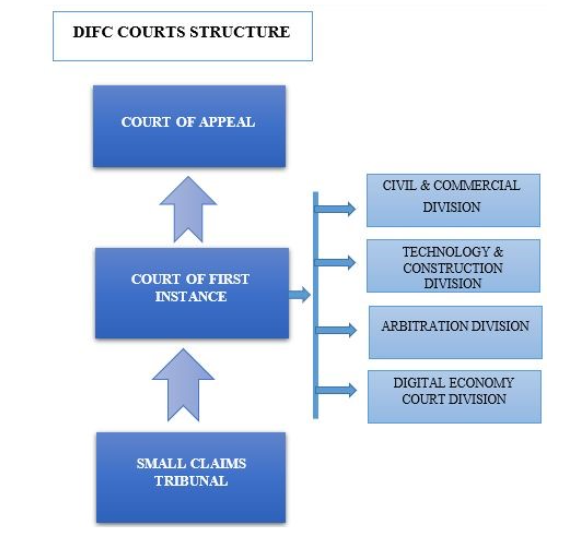

Structure of the DIFC Courts

The Structure of the DIFC Courts is easily understood from the diagram below:

Small Claims Tribunal

- The Small Claims Tribunal (SCT) can hear claims within the jurisdiction of the DIFC in three situations.

- Where the amount or value of the claim does not exceed AED 500,000.

- When the claim relates to the employment or former employment of a party and the amount or value of the claim exceeds AED 500,000, all parties to the claim elect in writing that it be heard by the SCT.

- If in the context of claims which are not employment-related, the amount or value of the claim does not exceed AED 1 million, and all parties elect in writing that it be heard by the SCT as agreed in the initial agreement or subsequent to the dispute.

Court of First Instance

The Court of First Instance (CFI) has exclusive jurisdiction over any civil or commercial case when it relates to the DIFC, in the following context:

- Civil or commercial cases and disputes arising from or related to a contract that has been fulfilled, or a transaction that has been carried out, in whole, or in part, in the DIFC, or an incident that has occurred in the DIFC.

- Objections filed against a decision made by the DIFC’s bodies, which are subject to objection by the DIFC’s laws and regulations.

- Any application over which the Courts have jurisdiction under the DIFC’s laws and regulations.

- The Court of First Instance can hear cases when the contract in question specifies DIFC Courts’ jurisdiction (pre-dispute jurisdiction) or when both parties elect to use DIFC Courts to resolve a dispute which has already arisen (post-dispute jurisdiction).

- One Judge hears proceedings in the CFI.

Divisions of the CFI

Civil & Commercial Division

- The resolution of complex disputes arising out of civil and commercial matters

- The types of disputes that can be resolved through this Division are those relating to, but not limited to,

- employment,

- breach of contract,

- property and tenancy,

- banking & finance, which require specific expertise across the broad and complex expanse of disputes of this nature.

Technology & Construction Division

- Only hears technically complex cases related to technology and construction.

Arbitration Division

- Another important service rendered by the DIFC Courts is the Arbitration Division, particularly for entities in the MENA region.

- Adopting common law principles in their proceedings, these courts employ judges specialized in international arbitration to deal with:

- Appointment of independent arbitrators

- Interpretation of arbitrary agreements

- Implementation of interim measures for the duration of arbitrary proceedings

- Enforcement of the decision once the process concludes

Digital Economy Court Division

- Overseeing sophisticated national and transnational disputes related to current and emerging technologies across areas ranging from big data, blockchain, AI, fintech, and cloud services, to disputes also involving unmanned aerial vehicles (UAVs), 3D printing, and robotics.

Court of Appeal

This Court is comprised of at least three (3) Judges with the Chief Justiceor most senior Judge, presiding over the appeal cases.

The Court of Appeal has exclusive jurisdiction over:

- Appeals filed against Judgments and Awards made by the Court of First Instance;

- Interpretation of any article of the DIFC’s laws based upon the request of any of the DIFC’s bodies or the request of any of the DIFC’s establishments, provided that the establishment obtains leave of the Chief Justice in this regard. Such interpretation shall have the power of law.

- The Court of Appeal lays down the final order or judgment of the Courts, and no appeal shall be permitted from a decision of the Court of Appeal.

Enforcement of Judgments

Judgments issued by the DIFC Court may be enforced before the Dubai courts provided:

i) the judgment has been translated into Arabic; and

ii) the judgment is final and appropriate for enforcement (article 42(2), DIFC Courts Law No 10 of 2004 and article 7(2), Dubai Law No 12 of 2004 in respect of The Judicial Authority of the Dubai International Financial Centre).

Importantly, the Dubai and DIFC courts have recently signed a memorandum of understanding, whereby they are intending to establish a closer mutual co-operation promoting the rule of law in Dubai (2009 memorandum of understanding between Dubai courts and DIFC courts, entering into effect as from 16 June 2009). Furthermore, according to the recent Protocol of Enforcement between Dubai courts and DIFC courts more specifically (‘Summary of The Protocol of Enforcement between Dubai Courts and DIFC Courts’), DIFC judgments and orders should, essentially, be more easily enforceable before the Dubai courts and vice versa, provided they are final and appropriate for enforcement before the originating court. It should be cautioned that the memorandum of understanding cannot bypass the application of the relevant provisions of the federal law on civil procedure and that the actual legal status of the memorandum currently remains untested before the UAE courts. In particular, a judgment creditor should be alert that to be appropriate for enforcement before the UAE courts, a judgment will have to be Shari’ah-compliant.

Without doubt that the DIFC and its court system has developed into a leading ‘onshore’ capital market. Any international conglomerate that intends to do business in the DIFC will be well-advised to consult local counsel to ensure that it is fully aware of and familiar with the new legal environment it is settling into.