In a significant development for businesses operating in the UAE, the landscape of UAE corporate tax is undergoing a transformative shift. The latest developments, encapsulated in Cabinet Decision No. 100 of 2023 and Ministerial Decision No. (265) of 2023 have replaced the erstwhile Cabinet Decision No. 55 of 2023 bringing about critical adjustments to the taxation landscape for corporations and businesses operating within the Qualifying Free Zone Person (QFZP) framework.

Key Highlights of the Updated UAE Corporate Tax Law

-

Qualifying Income Redefined

The revised law now explicitly includes income derived from the ownership or exploitation of Qualifying Intellectual Property (QIP) in the Qualifying Income category. This expansion encompasses patents, copyrighted software (granted under UAE laws or foreign jurisdiction), or any right functionally equivalent to a patent, including utility models, intellectual property assets protecting plants and genetic material, orphan drug designations, and extensions of patent protection.

-

Exclusions and Safeguards

Notably, income from marketing-related intellectual property assets, such as trademarks, is expressly excluded from the Qualifying Income derived from the exploitation of Qualifying Intellectual Properties. Additionally, the updated cabinet decision ensures that income from the ownership or exploitation of intellectual property is not considered when calculating the total income for the de-minimis requirement, unless it falls under the Qualifying Income category. This safeguard protects entities deriving income from trademarks and other marketing-related IPs from penalties as Non-Qualifying Income.

-

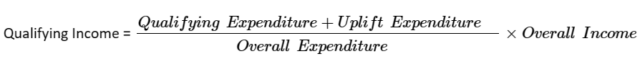

Formula for Qualifying Income Determination

The ministerial decision introduces a formula for determining the portion of total income derived from royalties or any other income through the ownership or exploitation of intangible property:

Any income exceeding the calculated Qualifying Income, as per the formula, will be considered taxable income and subjected to a 9% tax rate.

-

Outsourcing Flexibility for QFZE

Despite the mandate for Qualifying Free Zone Entities (QFZE) to conduct core income-generating activities within free zones or designated zones, the ministerial decision grants QFZE deriving income from IP assets the freedom to outsource activities to non-related parties even outside the state. However, this freedom comes with the condition that adequate supervision is maintained.

These significant changes offer a more nuanced and comprehensive framework for businesses operating within Qualifying Free Zones, aligning the UAE Corporate Tax Law with the evolving dynamics of the global business landscape.